Comparable exemptions apply, depending upon the policy which is purchased. In 2009, the main representative body of British Medical doctors, the British Medical Association, adopted a policy declaration revealing issues about developments in the health insurance coverage market in the UK. In its Yearly Representative Meeting which had been concurred previously by the Consultants Policy Group (i. e. Senior physicians) specifying that the BMA was "very worried that the policies of some personal healthcare insurance provider are preventing or limiting clients working out option about (i) the specialists who treat them; (ii) the medical facility at which they are dealt with; (iii) making leading up payments to cover any space in between the financing provided by their insurance provider and the cost of their picked personal treatment." It went in to "get in touch with the BMA to publicise these concerns so that patients are completely informed when choosing about private health care insurance." The practice of insurance coverage business deciding which consultant a client might view as opposed to GPs or clients is described as Open Recommendation.

The economic sector has been utilized to increase NHS capacity despite a big proportion of the British public opposing such involvement. According to the World Health Organization, government funding covered 86% of general health care expenses in the UK as of 2004, with private expenditures covering the staying 14%. Almost one in 3 patients receiving NHS health center treatment is independently insured and might have the expense spent for by their insurance company. Some personal plans provide cash payments to patients who go with NHS treatment, to deter usage of private facilities (What is pmi insurance). A report, by private health analysts Laing and Buisson, in November 2012, approximated that more than 250,000 operations were carried out on patients with private medical insurance each year at an expense of 359 million.

Personal medical insurance coverage does not normally cover first aid but subsequent healing might be spent for if the client were moved into a personal client system. On the 1st of August, 2018 the DHHS released a final rule which made federal changes to Short-Term, Limited-Duration Health Insurance Coverage (STLDI) which lengthened the maximum agreement term to 364 days and renewal for as much as 36 months. This brand-new rule, in combination with the expiration of the charge for the Individual Mandate of the Affordable Care Act, has actually been the topic of independent analysis. The United States healthcare system relies greatly on private medical insurance, which is the primary source of protection for the majority of Americans.

9% of American adults had private medical insurance, according to The Center for Disease Control and Avoidance. The Agency for Healthcare Research and Quality (AHRQ) found that in 2011, private insurance was billed for 12. 2 million U.S. inpatient hospital stays and sustained roughly $112. 5 billion in aggregate inpatient medical facility expenses (29% of the overall national aggregate expenses). Public programs provide the main source of coverage for the majority of senior people and for low-income children and households who satisfy particular eligibility requirements. The main public programs are Medicare, a federal social insurance coverage program for senior citizens and particular disabled people; and Medicaid, moneyed jointly by the federal government and states but administered at wesley careers the state level, which covers certain really low earnings kids and their households - How much is pet insurance.

All about When Is Open Enrollment For Health Insurance 2020

SCHIP is a vic donna group federal-state partnership that serves particular kids and households who do not receive Medicaid however who can not pay for private protection. Other public programs include military health benefits supplied through TRICARE and the Veterans Health Administration and benefits supplied through the Indian Health Service. Some states have additional programs for low-income individuals. In the late 1990s and early 2000s, health advocacy companies began to appear to help clients deal with the intricacies of the health care system. The intricacy of the health care system has resulted in a variety of issues for the American public. A study found that 62 percent of individuals declaring personal bankruptcy in 2007 had overdue medical expenses of $1000 or more, and in 92% of these cases the medical debts surpassed $5000.

The Medicare and Medicaid programs were estimated to soon account for half of all nationwide health costs. These factors and lots of others fueled interest in an overhaul of the healthcare system in the United States. In 2010 President Obama signed into law the Client Protection and Affordable Care Act. This Act includes an 'individual mandate' that every American should have medical insurance coverage (or pay a fine). Health policy specialists such as David Cutler and Jonathan Gruber, along with the American medical insurance coverage lobby group America's Medical insurance Plans, argued this provision was needed in order to provide "guaranteed issue" and a "neighborhood ranking," which deal with unpopular functions of America's medical insurance system such as premium weightings, exclusions for pre-existing conditions, and the pre-screening of insurance applicants.

The Client Defense and Affordable Care Act was determined to be constitutional on 28 June 2012. The Supreme Court identified that Congress had the authority to use the specific required within its taxing powers. In the late 19th century, "accident insurance coverage" started to be available, which ran just like modern-day disability insurance. This payment model continued till the start of the 20th century in some jurisdictions (like California), where all laws controling medical insurance really referred to impairment insurance coverage. Accident insurance coverage was very first offered in the United States by the Franklin Health Assurance Business of Massachusetts. This company, founded in 1850, offered insurance versus injuries developing from railroad and steamboat accidents.

by 1866, however the industry consolidated quickly quickly thereafter. While there were earlier experiments, the origins of illness protection in the U.S. efficiently date from 1890. The very first employer-sponsored group impairment policy was released in 1911. Prior to the advancement of medical expenditure insurance, patients were anticipated to pay healthcare costs out of their own pockets, under what is referred to as the fee-for-service organization design. What is life insurance. During the middle-to-late 20th century, traditional disability insurance coverage progressed into modern-day medical insurance programs. One significant challenge to this advancement was that early kinds of detailed medical insurance were advised by courts for breaching the traditional restriction on business practice of the occupations by for-profit corporations.

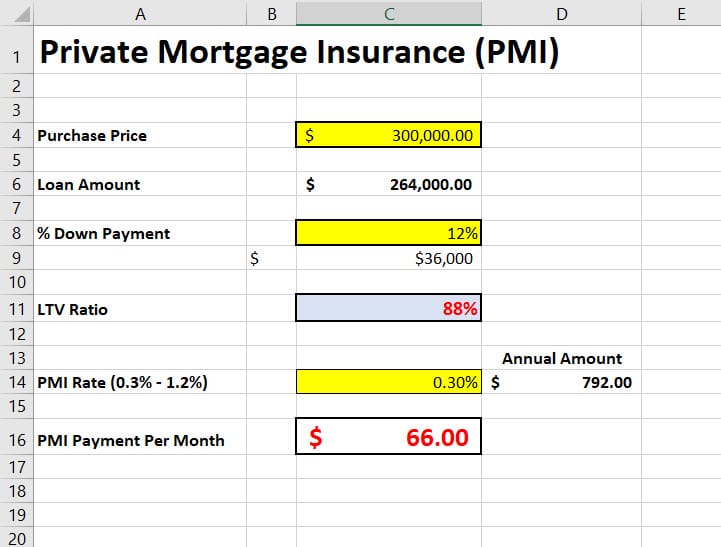

All about How To Get Rid Of Mortgage Insurance

Today, the majority of detailed private medical insurance programs cover Find more info the expense of routine, preventive, and emergency healthcare procedures. They also cover or partly cover the cost of specific prescription and non-prescription drugs. Insurance provider identify what drugs are covered based upon price, schedule, and healing equivalents. The list of drugs that an insurance program accepts cover is called a formulary. Additionally, some prescriptions drugs may require a prior permission prior to an insurance program concurs to cover its expense. The varieties of uninsured Americans and the uninsured rate from 1987 to 2008 Healthcare facility and medical expense policies were introduced during the first half of the 20th century.